英国海上保険法

1.英国海上保険法と海上保険

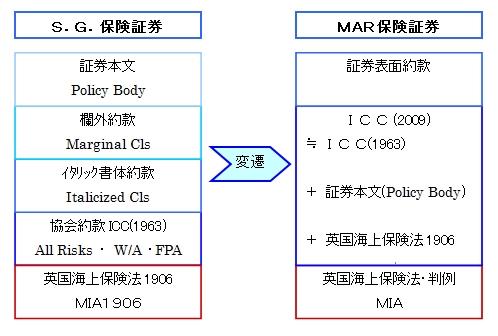

ICC(1963)協会約款は、SGフォーム証券を使用して、証券本文、欄外約款、協会約款(特別約款的な補完)および英国海上保険法(MIA)1906と判旨・判例により成り立っていましたが、ICC(1982)協会約款は、MARフォーム証券(担保危険等の保険条件の規定が無い)を使用して、協会約款にMIAの規定を取り込み、それ自体で標準約款としての自己完結できる内容となっています。

ICC(2009)協会約款は、ICC(1982)協会約款を基本に昨今の物流事情に合わせて被保険者に有利な内容に改定されています。

2.英国海上保険法1906(English Marine Insurance Act 1906)

An Act to codify the Law relating to Marine Insurance [21st December 1906]

赤色のタイトル表示は英文のみとなります。

| Marine Insurance |

1. MARINE INSURANCE DEFINED

2. MIXED SEA AND LAND RISKS

3. MARINE ADVENTURE AND MARITIME PERILS DEFINED

| Insurable Interest |

4. AVOIDANCE OF WAGERING OR GAMING CONTRACTS

5. INSURABLE INTEREST DEFINED

6. WHEN INTEREST MUST ATTACH

7. DEFEASIBLE OR CONTINGENT INTEREST

8. PARTIAL INTEREST

9. RE-INSURANCE

10. BOTTOMRY

11. MASTER’S AND SEAMEN’S WAGES

12. ADVANCE FREIGHT

13. CHARGES OF INSURANCE

14. QUANTUM OF INTEREST

15. ASSIGNMENT OF INTEREST

| Insurable Value |

16. MEASURE OF INSURABLE VALUE

| Disclosure And Representations |

17. INSURANCE IS UBERRIMAE FIDEI

18. DISCLOSURE BY ASSURED

19. DISCLOSURE BY AGENT EFFECTING INSURANCE

20. REPRESENTATIONS PENDING NEGOTIATION OF CONTRACT

21. WHEN CONTRACT IS DEEMED TO BE CONCLUDED

| The Policy |

22.CONTRACT MUST BE EMBODIED IN POLICY

23. WHAT POLICY MUST SPECIFY

24. SIGNATURE OF INSURER

25. VOYAGE AND TIME POLICIES

26. DESIGNATION OF SUBJECT-MATTER

27. VALUED POLICY

28. UNVALUED POLICY

29. FLOATING POLICY BY SHIP OR SHIPS

30. CONSTRUCTION OF TERMS IN POLICY

31. PREMIUM TO BE ARRANGED

| Double Insurance |

32. DOUBLE INSURANCE

| Warranties, Etc. |

33. NATURE OF WARRANTY

34. WHEN BREACH OF WARRANTY EXCUSED

35. EXPRESS WARRANTIES

36. WARRANTY OF NEUTRALITY

37. NO IMPLIED WARRANTY OF NATIONALITY

38. WARRANTY OF GOOD SAFETY

39. WARRANTY OF SEAWORTHINESS OF SHIP

40. NO IMPLIED WARRANTY THAT GOODS ARE SEAWORTHY

41. WARRANTY OF LEGALITY

| The Voyage |

42. IMPLIED CONDITION AS TO COMMENCEMENT OF RISK

43. ALTERATION OF PORT OF DEPARTURE

44. SAILING FOR DIFFERENT DESTINATION

45. CHANGE OF VOYAGE

46. DEVIATION

47. SEVERAL PORTS OF DISCHARGE

48. DELAY IN VOYAGE

49. EXCUSES FOR DEVIATION OR DELAY

| Assignment of Policy |

50. WHEN AND HOW POLICY IS ASSIGNABLE

51. ASSURED WHO HAS NO INTEREST CANNOT ASSIGN

| The Premium |

52. WHEN PREMIUM PAYABLE

53. POLICY EFFECTED THROUGH BROKER

54. EFFECT OF RECEIPT ON POLICY

| Loss and Abandonment |

55. INCLUDED AND EXCLUDED LOSSES

56. PARTIAL AND TOTAL LOSS

57. ACTUAL TOTAL LOSS

58. MISSING SHIP

59. EFFECT OF TRANSHIPMENT, &c.

60. CONSTRUCTIVE TOTAL LOSS DEFINED

61. EFFECT OF CONSTRUCTIVE TOTAL LOSS

62. NOTICE OF ABANDONMENT

63. EFFECT OF ABANDONMENT

| Partial Losses |

64.PARTICULAR AVERAGE LOSS

65. SALVAGE CHARGES

66. GENERAL AVERAGE LOSS

| Measure of Indemnity |

67. EXTENT OF LIABILITY OF INSURER FOR LOSS

68. TOTAL LOSS

69. PARTIAL LOSS OF SHIP

70. PARTIAL LOSS OF FREIGHT

71. PARTIAL LOSS OF GOODS, MERCHANDISE, &c.

72. APPORTIONMENT OF VALUATION

73. GENERAL AVERAGE CONTRIBUTIONS AND SALVAGE CHARGES

74. LIABILITIES TO THIRD PARTIES

75. GENERAL PROVISIONS AS TO MEASURE OF INDEMNITY

76. PARTICULAR AVERAGE WARRANTIES

77. SUCCESSIVE LOSSES

78. SUING & LABOURING CLAUSE

| Rights of Insurer on Payment |

79. RIGHT OF SUBROGATION

80. RIGHT OF CONTRIBUTION

81. EFFECT OF UNDER INSURANCE

| Return of Premium |

82. ENFORCEMENT OF RETURN

83. RETURN BY AGREEMENT

84. RETURN FOR FAILURE OF CONSIDERATION

| Mutual Insurance |

85. MODIFICATION OF ACT IN CASE OF MUTUAL INSURANCE

| Supplemental |

86. RATIFICATION BY ASSURED

87. IMPLIED OBLIGATIONS VARIED BY AGREEMENT OR USAGE

88. REASONABLE TIME, &c., A QUESTION OF FACT

89. SLIP AS EVIDENCE

90. INTERPRETATION OF TERMS

91. SAVINGS

92. REPEALS

93. REPEALS

94. SHORT TITLE

SCHEDULES

FIRST SCHEDULE (s 30)

Form of policy

Rules for construction of policy

Second Schedule